A leading economist believes that recent reports on the health of the U.S. economy point to an impending downturn.

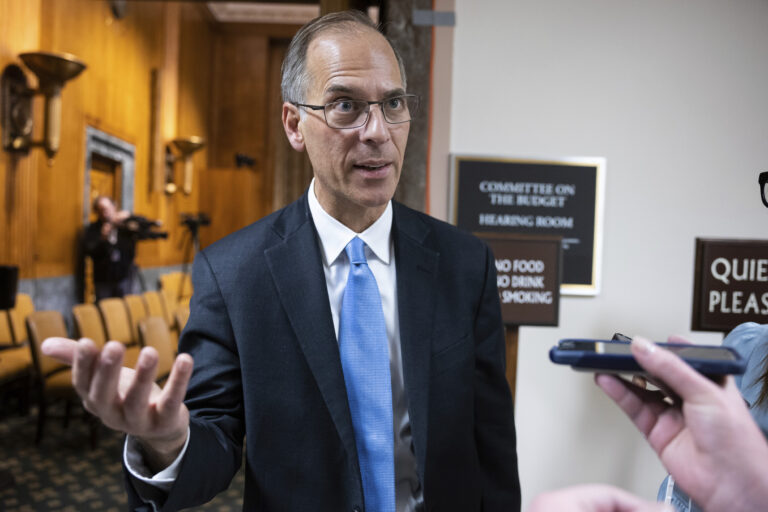

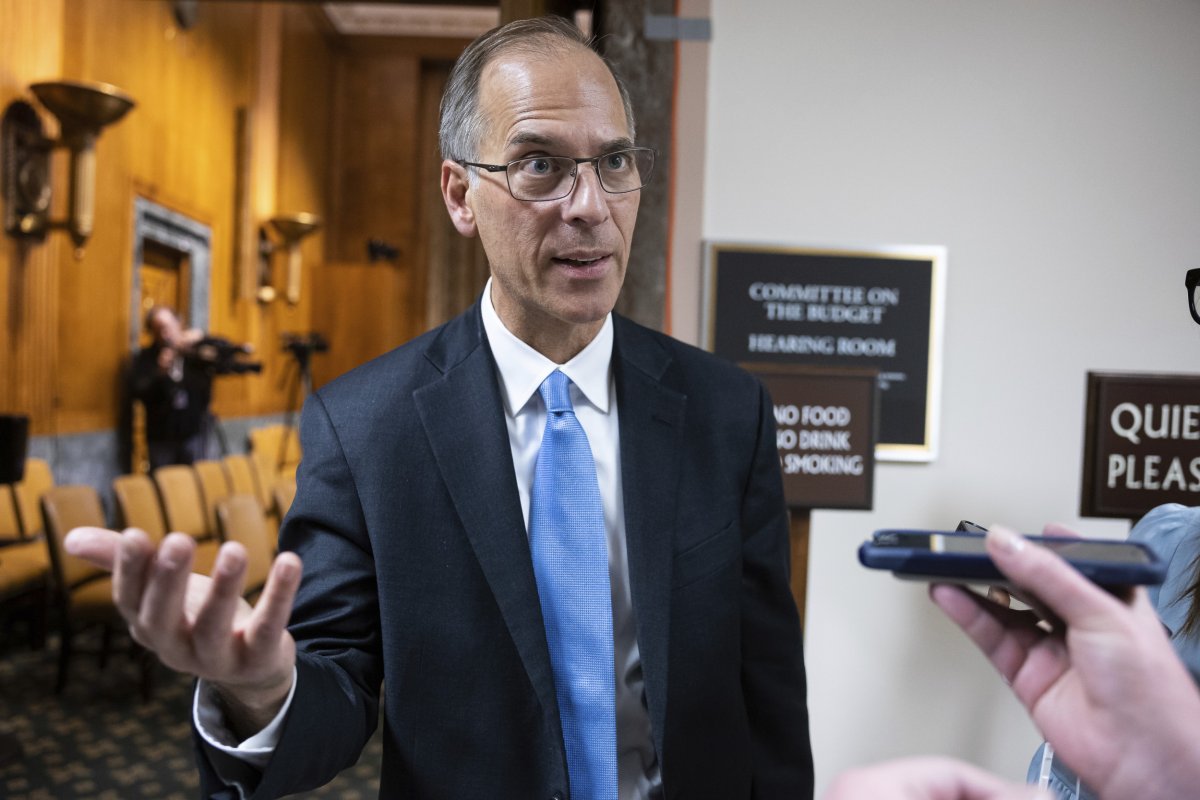

“The economy is on the precipice of recession. That’s the clear takeaway from last week’s economic data dump,” Moody’s Chief Economist Mark Zandi posted to X on Sunday. “Consumer spending has flatlined, construction and manufacturing are contracting, and employment is set to fall.”

Why It Matters

Zandi has sounded several similar alarms about the state of the U.S. economy in recent months, and the risks of a recession, which he has attributed largely to the trade policies of the administration and viewed as exacerbating more long-term vulnerabilities.

What To Know

Last week saw a tranche of key economic data published by various government agencies.

America’s trade deficit narrowed in June, consumer sentiment measures for July improved modestly following months of declines, and gross domestic product (GDP) growth rebounded sharply in the second quarter from a troubling contraction in the first, according to an advance estimate from the Department of Commerce.

However, as Zandi noted, other indicators were less encouraging. Manufacturing activity slowed in July, job openings in June fell by a greater-than-expected 275,000 and consumer spending, though growing, still lags behind the robust growth seen in 2024.

Much of this data was eclipsed by Friday’s employment report from the Bureau of Labor Statistics (BLS). This revealed that the U.S. economy added 73,000 jobs in July, well below forecasts. In addition, revisions to May and June’s figures showed that employment during these months was 258,000 lower than previously reported.

Francis Chung/POLITICO via AP Images

The substantial revision led President Donald Trump to say that the figures had been “RIGGED in order to make the Republicans, and ME, look bad,” and he immediately fired BLS Commissioner Erika McEntarfer.

The White House has defended McEntafer’s dismissal by pointing to perceived aberrations in both this and previous employment reports during her leadership, considering such large revisions “hard evidence” of politically motivated data manipulation.

But the move has been roundly criticized by Democratic lawmakers and certain Republicans, with many warning this sets a dangerous precedent for political interference in statistical reporting and will erode trust in the bureau’s future work.

“Any notion that the economic data misrepresents the reality of how the economy is performing is way off base,” Zandi wrote on Sunday. “The data always suffers big revisions when the economy is at an inflection point, like a recession. It’s thus not at all surprising that we are seeing big downward revisions to the payroll employment numbers.”

He added that cuts to the federal workforce by the Department of Government Efficiency (DOGE) were a “key factor” in the BLS revisions, given that government departments are often late in reporting payrolls to the bureau.

What People Are Saying

Moody’s Chief Economist Mark Zandi, via X: “It’s no mystery why the economy is struggling; blame increasing U.S. tariffs and highly restrictive immigration policy. The tariffs are cutting increasingly deeply into the profits of American companies and the purchasing power of American households. Fewer immigrant workers means a smaller economy.”

Economist Jared Bernstein wrote on Monday: “It’s not that the BLS did something wrong. It’s that, as usual, they did something right. They got new data with which they updated/revised the old data. The fact that the revision was history large and negative just tells us that the labor market was a lot weaker than we thought it was.”

He added that the downward revision does “not necessarily” mean the U.S. is headed for a recession, but that weak consumer spending and investor demand will continue to weigh on economic growth and labor market health.

White House press secretary Karoline Leavitt said following last week’s GDP reading: “Today, GDP growth came in above market expectations, and yesterday, consumer confidence rose. Americans trust in President Trump’s America First economic agenda that continues to prove the so-called ‘experts’ wrong. President Trump has reduced America’s reliance on foreign products, boosted investment in the U.S., and created thousands of jobs—delivering on his promise to Make America Wealthy Again.”

What Happens Next?

As Zandi noted in his post, resilient labor market conditions had been one of the key factors factors undergirding the Federal Reserve’s wait-and-see approach, and holding off on rate cuts while it works to get a clearer grasp on inflationary pressures.

But, with inflation still ticking above its 2 percent target, he said “it is tough for the Fed to come to the rescue.”

On Friday, Goldman Sachs Chief Economist Jan Hatzius said the troubling revisions to recent jobs data made it “very, very likely” the central bank would cut rates at its September meeting.