Betting markets are signaling growing fears of a U.S. recession in 2025, with odds surging after President Donald Trump announced sweeping new tariffs on global trading partners Wednesday.

By Thursday, the likelihood of a 2025 downturn surpassed 50 percent on Kalshi and hit 47 percent on Polymarket, marking historic highs on two of the world’s most closely watched prediction platforms.

Why It Matters

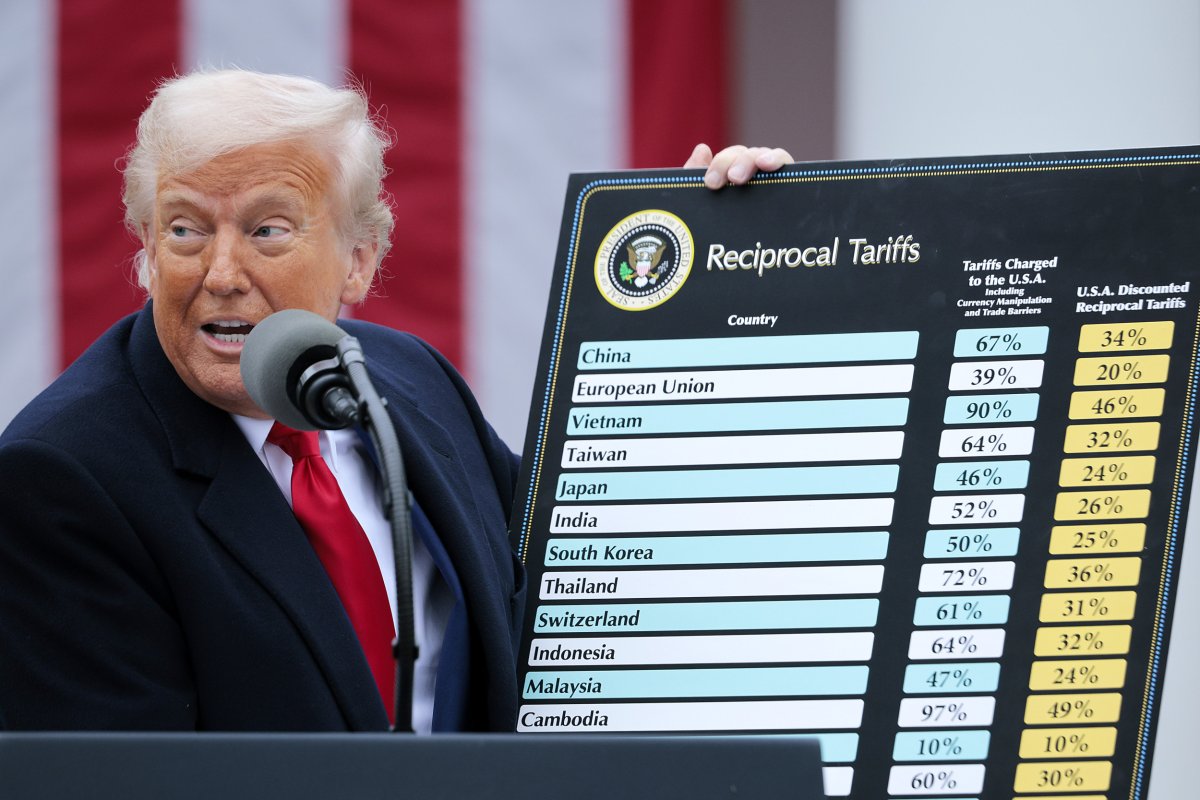

On what the Trump administration dubbed “Liberation Day,” the president unveiled a set of tariffs targeting nearly every major U.S. trade partner. A 10 percent baseline duty on all imports would be followed by sharper measures aimed at longtime allies and rivals alike. Within hours, markets recoiled, and prediction platforms began pricing in a grim new outlook.

What to Know

The sharp turn in prediction markets signaled more than just volatility—it marked a shift in sentiment, with many now viewing a recession as a coin flip rather than a distant risk. On Kalshi, a regulated platform for trading on economic outcomes, the probability of a U.S. recession in 2025 jumped to 54 percent, up from 42.9 percent the day before.

Polymarket mirrored the surge, leaping 14 points from 39 percent as Trump spoke to 53 percent before settling just below the halfway mark. More than $1 million in bets have been placed on the question.

Markets moved just as swiftly. The Nasdaq was down 5 percent midday Thursday. Apple, Nvidia, and Tesla—heavyweights with deep exposure to global trade—saw their shares tumble between 5 and 8 percent. The Dow Industrials were trading lower by 1,300 points, with the S&P 500 lower by 4 percent.

More

Photo by Spencer Platt/Getty Images

Europe took similar hits. Germany’s DAX dropped 2.3 percent, while France’s CAC fell 2.5 percent. The dollar lost nearly 2 percent against a basket of foreign currencies, prompting Deutsche Bank to warn clients of a “dollar confidence crisis.”

Analysts told Newsweek the abrupt moves reflect growing concern that the tariffs could depress consumer spending, spike inflation, disrupt supply chains, and squeeze already fragile corporate margins—effects that may force the Federal Reserve to shift course.

“Investors are increasing their bets that the Federal Reserve will be forced to cut interest rates this year, as President Donald Trump’s trade war intensifies concerns about economic growth,” said Professor Todd Belt, director of George Washington University’s Graduate School of Political Management.

The CME FedWatch Tool showed the odds of a quarter-point rate cut in May jumping from 10.62 percent to 26 percent overnight, with traders pricing in a full 100 basis points of cuts by year-end.

“The president just announced the de facto separation of the U.S. economy from the global economy,” said Mary Lovely, senior fellow at the Peterson Institute for International Relations. “The stage is set for higher prices and slower growth over the long term.”

What the Trump Administration Has Said

In a Truth Social post following the announcement, President Trump defended the move by comparing it to a surgical procedure. “The patient has lived and is healing,” he wrote, calling the policy a tool to build a “stronger and more resilient” economy.

Treasury Secretary Scott Bessent, seen by experts and investors as the common-sense voice in the room, also defended the measure and warned U.S. trading partners against retaliation.

Chip Somodevilla/Getty Images

“I would advise none of the countries to panic… I wouldn’t try to retaliate, because as long as you don’t retaliate, this is the high end of the number,” he said after the announcement. In a Fox News interview later that night, he emphasized the point: “My advice to every country right now is: do not retaliate. Sit back, take it in, let’s see how it goes. Because if you retaliate, there will be escalation.”

Commerce Secretary Howard Lutnick also emphasized that for tariffs to be reduced, other countries need to amend their trade policies to allow more U.S. imports.

“I expect most countries to start to really examine their trade policy toward the United States of America and stop picking on us,” he said in an interview with CNBC.

White House Press Secretary Karoline Leavitt weighed in as well, criticizing rhetoric from politicians and the media, and arguing that “studies have repeatedly shown tariffs are an effective tool for achieving economic and strategic objectives.”

What People Are Saying

White House Press Secretary Karoline Leavitt in a press release on Thursday: “For the first time in decades, the United States will see fair trade as President Donald J. Trump announces tariffs to level the playing field for American workers and businesses.”

China’s Foreign Ministry spokesperson Guo Jiakun told the Associated Press: “There are no winners in trade wars and tariff wars, and protectionism is not a way out … It is clear to everyone that more and more countries are opposing the U.S.’s unilateral bullying actions, such as imposing tariffs.”

Todd Belt of George Washington University’s Graduate School of Political Management told Newsweek: “The industrial landscape in the U.S. has completely changed. Most heavy industry has left the country, along with many well-paying, middle-class, union jobs. That’s created a lot of resentment. Trump is promising to bring those jobs back—though I don’t think that’s realistic—and tariffs are his way of doing it”.

What Happens Next

With investors fleeing risk, gold surged to an all-time high of $3,167.50 per ounce as oil prices tumbled. Brent crude fell 5.8 percent to $70.61 per barrel on Wednesday, reflecting expectations of weaker global demand, while the broader market remained in sell-off mode ahead of the closing bell.