The United States is experiencing a surge in reshoring, bringing manufacturing jobs back from overseas.

This impacts economic growth, job creation, and the country’s industrial future, but the effects could be more intensely felt in certain states, according to a new report from Visual Capitalist.

An expert told Newsweek in part, “States like South Carolina, Alabama, Mississippi, and Louisiana are benefiting because rising costs overseas—driven by tariffs—are forcing suppliers to rethink their strategies.”

Why It Matters

Millions of manufacturing jobs are set to return to American soil by the end of 2025, according to Visual Capitalist. This is part due to President Donald Trump’s push for domestic manufacturing alongside his recently enacted tariffs on foreign countries’ imports.

As this occurs, global supply chain disruptions, shifting costs, and major corporate investments could reshape the employment landscape.

These changes do not benefit every state equally, with significant regional disparities emerging, the report found, however.

What To Know

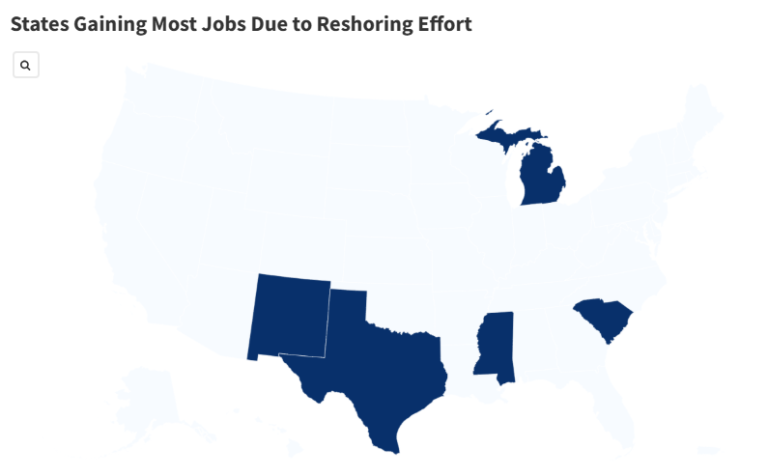

Texas has emerged as the top state benefiting from reshoring, adding more than 40,200 manufacturing jobs as of 2025. That’s nearly 23 percent of all positions created through these initiatives nationwide.

Major factors fueling this growth in Texas include $65 billion in investment from Samsung, $5.5 billion from Tesla, and $4.9 billion in public infrastructure projects.

South Carolina ranks second, claiming 24,800 reshored jobs, with Mississippi (12,100), New Mexico (9,800), and Michigan (8,700) rounding out the top five. Together, these four states account for 32 percent of reshored jobs in the country.

Further down the list are Alabama (8,600), Washington (7,900), Louisiana (7,800), and Ohio (6,400).

Louisiana’s growth is linked to investments by companies such as Hyundai Motor Group, Syrah Resources, Shell Catalysts & Technologies, Intralox, Prolec GE, Mid South Extrusion, Ascentek, Inc., and Climeworks, according to the Louisiana Economic Development.

“States like South Carolina, Alabama, Mississippi, and Louisiana are benefiting because rising costs overseas—driven by tariffs—are forcing suppliers to rethink their strategies. It’s simply becoming more cost-effective to bring jobs back home,” Kevin Thompson, the CEO of 9i Capital Group and the host of the 9innings podcast, told Newsweek.

The distribution of jobs is highly concentrated by industry. Computer and electronics manufacturing leads with roughly 68,700 new positions, which is about one-third of all reshoring gains. Transportation follows with 52,500 jobs, while electrical equipment adds 34,800 (17 percent).

Chemicals and primary metals contribute 11,000 and 9,000 jobs, respectively, as reported by Visual Capitalist and GlobeSt.

Major corporations driving reshoring include Walmart, which has announced plans for 300,000 new jobs, as well as Apple (20,000 jobs), CMA CGM (10,000), and GE Aerospace (5,000). Other contributors are Stellantis, GE Vernova (1,500 each), and Siemens (over 900).

“Given the increased reliance on a virtual marketplace versus brick and mortar, many employers are able to save money on production they were unable to do in the past while also requiring better-trained new hires,” Alex Beene, a financial literacy instructor for the University of Tennessee at Martin, told Newsweek.

The full top 10 list of states most impacted by reshoring efforts is as follows:

Texas (40,200 jobs)South Carolina (24,800 jobs)Mississippi (12,100 jobs)New Mexico (9,800 jobs)Michigan (8,700 jobs)Alabama (8,600 jobs)Washington (7,900 jobs)Louisiana (7,800 jobs)Ohio (6,400 jobs)North Carolina (5,200 jobs)

Maddie McGarvey-Pool/Getty Images

What People Are Saying

Drew Powers, the founder of Illinois-based Powers Financial Group, told Newsweek: “We now live in a global economy, and that is never going to change. But in the US, we let the pendulum swing too far, and we became dependent on the global supply chain for 100% of our needs in certain sectors. Reshoring is a process that brings the balance closer to the most efficient and effective outcome over time, where we do not outsource everything, even if just to hedge against supply-chain disruptions.”

Kevin Thompson, the CEO of 9i Capital Group and the host of the 9innings podcast, told Newsweek: “The long-term implication is clear: many of the jobs being reshored will ultimately be automated. Government incentives and tariff policies are encouraging suppliers to bring work back, but companies are also looking at ways to reduce their biggest expense—the employee.”

Alex Beene, a financial literacy instructor for the University of Tennessee at Martin, told Newsweek: “Obviously, some will point to efforts from the new administration to have more tariffs on items imported from outside the United States, but the reality is most of the movement was in the works well before the White House changed hands. Factors vary per company, but it’s a mixture of a need for more highly skilled labor for certain roles and economic incentives from some states, most heavily in the Southeastern United States, to attract employers.”

What Happens Next

Reshoring is projected to add as many as 2.3 million jobs to the U.S. economy by the close of 2025, according to Visual Capitalist.

As companies continue to announce new domestic investments, states that successfully attract these projects may see additional employment gains and economic growth. However, the gains could be short-term, experts say.

“The (Trump) administration has already acknowledged that a significant portion of these jobs will be integrated with robotics,” Thompson said. “While that strengthens the supply chain, we shouldn’t expect a massive increase in jobs held by humans over the long run.”