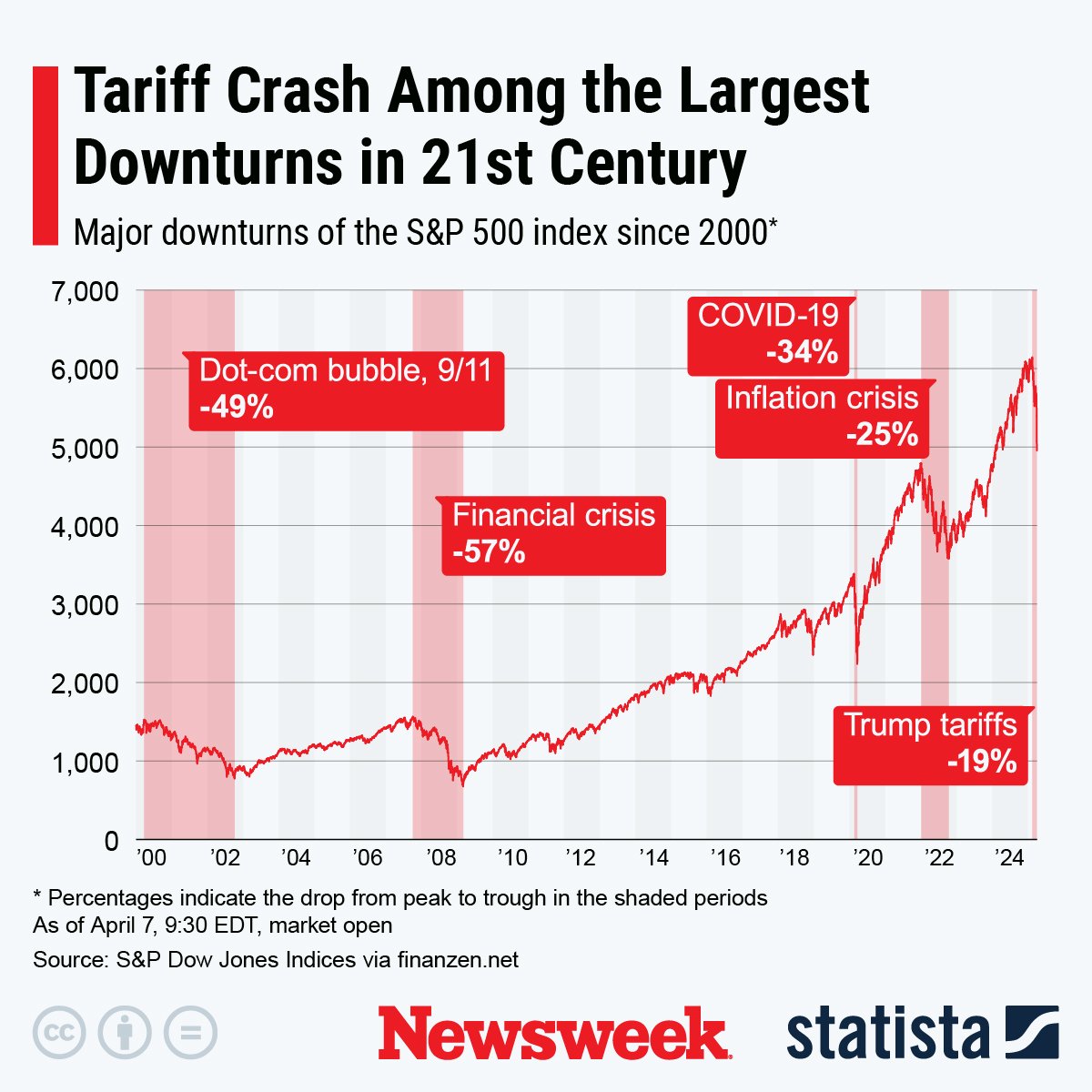

Last week’s tariff announcements dragged U.S. stocks lower, marking one of the most severe weeks for Wall Street in recent memory.

Still, even with the tariff tensions, concerns over retaliation from U.S. trading partners and ongoing recession fears leading up to what President Donald Trump called Liberation Day, the current downturn has not yet reached the scale of the most significant stock market crashes in American history.

Current Market Performance (April 2025)

Recent volatility has been fueled by the uncertainty surrounding the administration’s tariff policies and by Wednesday’s announcement of a 10 percent tax on all imports and reciprocal tariffs on dozens of trading partners.

Trump’s Liberation Day speech sparked a mass selloff, with stocks diving in one of the worst days of trading this century.

The S&P 500 witnessed its largest two-day decline since March 2020 on Thursday and Friday, with the Dow Jones Industrial Average and Nasdaq Composite seeing similarly steep drops, shedding 9.3 percent and 11.4 percent of their value over the same period.

When compared to their recent respective peaks, all three indices have registered significant losses that rival some of the worst periods in their history.

Between February 19 and markets closing on Friday, the Dow has dropped 14.1 percent, the S&P 500 17.4 percent and the tech-heavy Nasdaq Composite 22.3.

The Great Depression (1929)

After what historians acknowledge was a sustained period of speculative investment, in which stock prices soared well beyond their actual value, a sudden decline in confidence prompted the market to crash in late October 1929.

On October 28 and 29—referred to as Black Monday and Black Tuesday—the Dow fell by 13 percent and then nearly 12 percent.

The steady decline lasted for years, with the index falling from 362.35 in September 1929 to close at a 20th-century-low of 41.22 in early July 1932, a drop of 89 percent. It wasn’t until 1954 that the market recovered to pre-crash levels.

Photo Illustration by Newsweek/Getty Images

Black Monday (1987)

Unlike the Great Depression, the 1987 crash was triggered by a host of causes, including feedback selling loops created by the incorporation of automated trading strategies, the overvaluation of stock prices and lingering concerns about inflation.

On October 19, 1987—a day also known as Black Monday”— the Dow Jones Industrial Average dropped 22.6 in a single day, still the largest one-day percentage decline in the index’s history.

The 11.4 percent decline in the Nasdaq Composite and 20.5 percent decline in the S&P 500 are still among the largest single-day drops ever.

While the stock market recovered over the next two years, the sudden crash prompted the New York Stock Exchange to introduce circuit breakers—temporary halts in trading intended to calm markets and prevent panic selling—which kick in when stock prices fall too sharply, too fast.

Dot-Com Bubble Burst (2000-2002)

Technological optimism and excessive speculation in internet-based companies led to a rapid rise in U.S. equity valuations during the late 1990s. Once investors realized the companies in which they had acquired major stakes lacked long-term fundamentals, the bubble burst, leading to the rapid selloff of tech stocks.

As a result, the Nasdaq Composite fell more than 70 percent between February 2000 and October 2002.

Global Financial Crisis (2008)

The bear market of 2007 to 2009, triggered by the subprime mortgage crisis, saw all three indices drop more than 50 percent from their peaks.

Between October 2007 and March 2009, the S&P 500 plunged 57 percent, the Dow declined 54 percent and the Nasdaq Composite lost 56 percent of its value.

COVID-19 Pandemic Crash (2020)

In March 2020, pandemic fears caused the U.S. stock market to enter freefall. All three indices declined by about 30 percent from their February peaks by late March.

March 16, 2020, still represents the largest single-day percentage drop for the Nasdaq (12.3 percent), the second largest for the Dow (12.9 percent) and the third largest for the S&P 500 (12.0 percent).

While this month’s declines have been substantial, they have so far proved far less severe than the selloffs that swept markets during other periods of economic turmoil.

Whether the current bear market will be able to rival the crashes of 2020 or 2008 will depend on how investors react to the next moves by the Trump administration and America’s trading partners.

Statista

What People Are Saying

KPMG Chief Economist Diane Swonk told CNN ahead of markets opening on Monday: “The markets are saying no, [tariffs] fail on all fronts. That’s very important to take into account. What the markets are worried about now is that we not only have a recession, but we could have stagflation with tariffs. That is the nature of tariffs. They’re so large that they both force layoffs because firms can’t absorb all of the costs, but they also force them to pass along some of those costs to consumers.”

Treasury Secretary Scott Bessent, speaking to NBC News on Sunday: “Markets are organic animals and you never know what the reaction’s going to be….We get these short-term market reactions from time to time.”

What Happens Next

“I see no reason that we have to price in a recession,” Bessent said on NBC News on Sunday.