Africa’s vast mineral wealth is reshaping global power dynamics in the 21st century, sparking a new geopolitical contest between China and the United States.

While Beijing has long held a dominant position in trade across the continent, the emerging fight for control over resources crucial to electric vehicles, renewable energy and defense systems signals a high-stakes shift.

The scramble for these raw materials is more than an economic rivalry; it’s a contest for technological leadership and strategic autonomy in a rapidly changing world.

Africa holds nearly 30 percent of the world’s proven reserves of minerals like cobalt, lithium and rare earth elements. As global demand surges—expected to increase anywhere from two to 10 times by 2050—the continent’s resource wealth is emerging as a linchpin for global technological and economic futures.

This shift elevates Africa from a supplier of raw materials to a central player in the strategic competition between global powers.

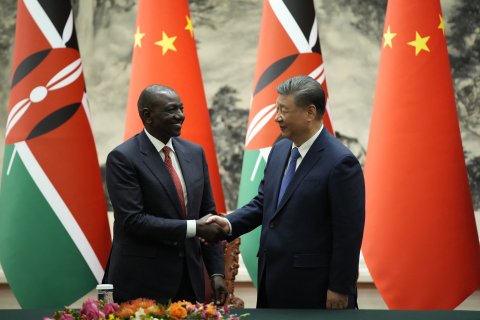

Sergei Chuyko/Getty

China’s economic footprint in Africa has expanded dramatically over the past two decades. The country’s investments in infrastructure, from railways to ports, have cemented strong trade ties.

According to Visual Capitalist, almost all African countries now conduct more trade with China than with the U.S. This dominance is clear, with China’s trade volume in Africa vastly outpacing that of the U.S., setting the context for an intensifying rivalry across multiple economic fronts.

In 2003, China was the top trading partner for 18 African countries—just 35 percent of the continent. Two decades later, that number has surged: by 2023, 52 out of 54 African nations (97 percent) traded more with China than with the United States.

In 2024, China-Africa trade reached $295 billion, a 6 percent increase from the previous year.

While China leads in overall trade, the competition over critical minerals has emerged as a pivotal front in U.S.-China tensions. These minerals are vital for strategic technologies critical to economic and national security.

Afshin Molavi, senior fellow at the Foreign Policy Institute of the Johns Hopkins University School of Advanced International Studies, told Newsweek: “Africa sits at the fulcrum of the 21st-century resource economy. The challenge lies in ensuring that this mineral wealth translates into broad-based development. The current global push for green technologies offers a new window to rewrite that dynamic.”

IORI SAGISAWA/POOL/AFP/Getty Images

Beijing’s Strategy

China’s approach has been intense and long-term. Although Chinese firms account for less than 10 percent of Africa’s total mining output, according to Eric Olander, editor-in-chief of multimedia initiative The China-Global South Project, its influence is outsized in key sectors.

“The Chinese mining presence in Africa is largely concentrated in a few select areas like Guinea, Zambia, DR Congo and Zimbabwe,” Olander told Newsweek. These are precisely the regions rich in the minerals powering the global energy and technological transition.

What makes China’s grip formidable is its dominance in refining and processing. Even when raw materials are mined outside of China, as much as 60-80 percent of global refining capacity—especially for cobalt, lithium and rare earths—takes place in China. This allows Beijing to control global supply chains.

Molavi noted that “these resources have become more than commodities; they are now strategic assets,” adding that China’s model of vertically integrated mineral control gives it a structural advantage over Western rivals.

The U.S., meanwhile, has largely been absent from Africa’s mining landscape.

Olander said: “The U.S. mining presence in Africa is minuscule compared to what China is doing, so it’s not really accurate to frame this as a competition. That’s not to say that U.S. mining companies won’t eventually make their way into these markets, they just aren’t there now in any meaningful way.”

He added that Washington has recognized the strategic imperative but has yet to match rhetoric with action.

“The Trump administration is amplifying the need to break the current U.S. dependence on Chinese critical mineral supply chains, as Biden did as well, and that includes building up both extractive and refining capacities in places like Africa. The problem, at least for now, is that the U.S. is a lot more talk than action,” Olander said, citing risk aversion and weak price incentives as deterrents for U.S. firms.

More

JIM WATSON/AFP/Getty

Washington’s Policy Shift

That’s where the Trump-brokered peace deal between the DRC and Rwanda enters the picture. Signed in June, the agreement aims to stabilize eastern Congo, where vital mineral resources are located.

President Donald Trump linked diplomacy directly to resource access, saying: “We’re getting, for the United States, a lot of the mineral rights from the Congo as part of it.”

The deal signals a notable shift in U.S. policy, linking peace-building efforts directly with strategic resource access.

On July 9, President Trump hosted a summit at the White House with five African leaders—from Gabon, Guinea-Bissau, Liberia, Mauritania and Senegal—to discuss expanding economic ties and countering China’s growing influence on the continent.

Capturing Africa’s perspective, Gabonese President Brice Oligui Nguema stated: “We are not poor countries. We are rich countries when it comes to raw materials. But we need partners to support us and help us develop those resources with win-win partnerships.”

The peace deal between Rwanda and the DRC marks the beginning of a new geopolitical chapter in Africa’s mineral-rich heartland. As the U.S. seeks to reassert its influence and China defends its trade and strategic foothold, the contest is expected to intensify.

With African nations in a rare position of leverage, the outcome will depend not only on foreign investment but also on the political will of local leaders to demand transparency, value addition, and long-term benefits for their people.